How to Pay Satara Property Tax Online, Offline, and via Mobile App

How to Pay Satara Property Tax Online, Offline, and via Mobile App

Paying property tax is a crucial responsibility for property owners in Satara. The Satara Municipal Council offers multiple methods to facilitate this process. Here's a step-by-step guide on how to pay your Satara property tax online, offline, and via a mobile app, along with information on rebates, due dates, name change procedures, and contact information.

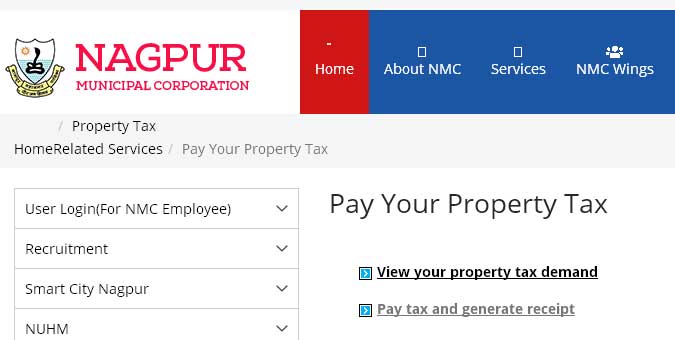

How to Pay Satara Property Tax Online - Paying Satara Property Tax Online

1. Visit the Official Website

Go to the Satara Municipal Council official website at Satara Property Tax Payment - https://sataranp.in/?english=true.

2. Navigate to Property Tax Payment

Click on the 'Property Tax' section on the homepage.

3. Enter Property Details

Provide your property details, such as Property ID or Owner Name, to retrieve the tax information.

4. Verify Tax Amount

Check the property tax amount due and any applicable rebates.

5. Make Payment

Choose a payment method (net banking, credit/debit card, UPI) and complete the transaction. Save the payment receipt for your records.

How to Pay Satara Property Tax Offline - Paying Satara Property Tax Offline

1. Visit the Satara Municipal Council Office

Go to the nearest Satara Municipal Council office.

2. Fill Out the Property Tax Form

Fill out the required property tax form with accurate property details.

3. Submit the Form and Pay

Submit the form and make the payment at the counter via cash, cheque, or demand draft. Collect the receipt as proof of payment.

How to Pay Satara Property Tax via Mobile App - Paying Satara Property Tax via Mobile App

1. Download the Mobile App

Download the Satara Municipal Council mobile app from the Google Play Store or Apple App Store.

2. Register or Login

Register or log in using your credentials.

3. Navigate to Property Tax Section

Click on the 'Property Tax' section.

4. Enter Property Details and Pay

Enter your property details, verify the tax amount, and proceed with the payment. Save the digital receipt for future reference.

Satara Property Tax Rebates and Last Date to Pay Tax

The Satara Municipal Council offers a rebate of 8% for early property tax payments made before the due date. 1% discount is also added if the Satara property tax is made online. Please check with the official website for last date to pay Satara property tax.

How to Change Name in Satara Property Tax Records - Changing Name in Satara Property Tax Records?

Property owners in Satara can change their names in property tax records either online or offline. For the online mode, follow these steps:

1. Visit the Mahabhumi Portal

Go to the official Mahabhumi portal at https://digitalsatbara.mahabhumi.gov.in/pc_status and select '7/12 Property Mutation'.

2. Choose Mutation Details

Select the mutation number or document number followed by district, taluka, and village circle.

3. Login and Enter Captcha

Provide your login details and enter the captcha.

4. Check Property Details

Verify the property details. Click on 'Apply for property mutation in Satara' and complete all the formalities.

Satara Municipal Corporation Contact Information

For any queries or assistance, you can contact the Satara Municipal Council at:

Address: Satara Municipal Council, Satara, Maharashtra - 415001

Phone: 02162-233422

Email: sataramc@gmail.com

By following these steps, you can efficiently manage your Satara property tax payments and records, ensuring compliance and taking advantage of available rebates.